When someone says they’re going to "sell a home for cash," it means they're accepting an offer from a buyer who has the money on hand—no mortgage needed. This is a game-changer because it cuts the banks completely out of the picture.

No more waiting on underwriters, no more agonizing over appraisals, and no more deals falling apart at the last minute because the buyer's loan got denied. For homeowners here in Fayetteville and Cumberland County, it's the most direct path to a fast, clean sale without worrying about repairs, commissions, or financing contingencies.

Deciding if a Cash Home Sale is Right for You

Choosing to sell your home for cash isn't just about getting it done quickly; it's a strategic move that depends entirely on your situation.

Sure, a traditional listing with a real estate agent might dangle a higher price tag in front of you. But that route comes with a whole package of uncertainties—inspections that uncover problems, appraisals that come in low, buyers who can't get financing, and the endless parade of strangers walking through your home for showings.

For a lot of homeowners, the absolute certainty and sheer simplicity of a cash offer are worth more than the potential for a slightly higher price.

It really boils down to what you value more: squeezing every last penny out of the deal or prioritizing convenience, speed, and peace of mind.

Think about it from a local perspective. A military family at Fort Liberty facing a tight PCS timeline can't afford to have their home sale drag on for months. An out-of-state owner who just inherited a property in Hope Mills probably doesn't want the headache of managing repairs and showings from hundreds of miles away. In scenarios like these, a cash sale is a clean, efficient exit.

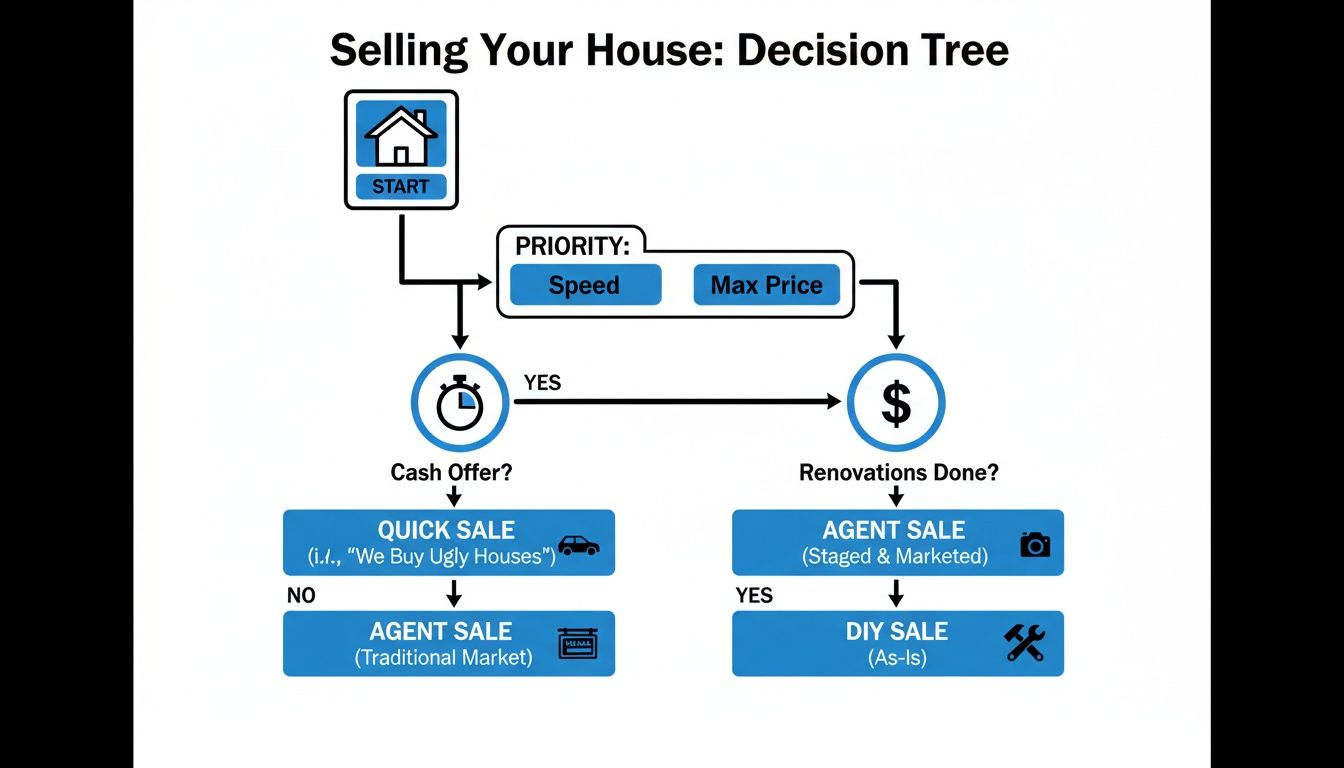

This decision tree helps lay it all out visually. It's a simple way to see the two main paths: one focused on a fast, guaranteed sale and the other on holding out for the absolute maximum price.

As you can see, if your main goal is speed and avoiding hassle, selling for cash is the straightest line to the finish.

When a Cash Offer Makes the Most Sense

Some situations just scream for a cash offer. It's a powerful problem-solver for homeowners who are up against the clock or facing financial stress—times when the traditional market just can't move fast enough.

Here are a few scenarios we see all the time:

- Facing Foreclosure: When the bank is breathing down your neck, time is everything. A cash sale can close quickly enough to pay off the mortgage and protect your credit. It's a way out that avoids the stress and public embarrassment of an auction. We have a detailed guide that explains more about how you can stop foreclosure on your home.

- Overwhelming Repair Costs: Does the house need a new roof? Have foundation issues? Are the HVAC and plumbing on their last legs? Getting a home like that ready for the market can cost a fortune. A cash buyer like DIL Group buys properties "as-is." That means you don’t spend a single dollar on repairs.

- Inherited or Unwanted Property: Dealing with an inherited home, especially if you live out of state, is a huge burden. You've got taxes, maintenance, and the emotional task of clearing out personal belongings. A cash sale cuts through all that complexity, letting you settle the estate and move on.

- Urgent Relocation: Whether you're moving for a new job or getting PCS orders, a fast, guaranteed sale gives you the certainty you need. You can move forward without the anchor of a second mortgage or the worry of managing a vacant property from afar.

Cash Sale vs Traditional Listing: A Fayetteville Homeowner’s Comparison

To really understand the difference, it helps to see the two options side-by-side. For homeowners in our area, the choice between speed and a potentially higher price is a very real one. This table breaks down what you can expect from each path.

| Factor | Selling for Cash (e.g., DIL Group Buyers) | Traditional Market Listing |

|---|---|---|

| Closing Timeline | As fast as 7-14 days | Typically 45-90+ days, depending on financing |

| Repairs & Prep | None. We buy "as-is." | Usually requires repairs, staging, and cleaning |

| Commissions | Zero. No agent fees. | 5-6% of the sale price paid to agents |

| Financing Risk | None. The deal is not contingent on a loan. | High. Buyer's financing can fall through. |

| Showings | Just one walkthrough with us | Multiple showings, open houses, and disruptions |

| Offer Certainty | High. The offer is firm and guaranteed. | Low. Initial offer can be reduced after inspections. |

| Sale Price | Fair offer based on condition, minus repair costs | Potentially higher, but reduced by fees and costs |

Ultimately, there's no right or wrong answer—just the right answer for you. If your home is in perfect shape and you have time to wait, a traditional sale might be a great fit. But if you need to sell quickly and without any extra cost or stress, a cash sale offers a level of certainty you just can't get on the open market.

The Growing Trend of Cash Transactions

Selling for cash isn't some niche, last-resort option anymore. It's become a mainstream strategy for a huge part of the market.

National data shows that roughly one in three homes is now sold for cash. This isn't a fluke; it's a trend driven by sellers who are tired of the gamble of the open market and are choosing certainty and speed instead.

This shift means that local buyers right here in North Carolina, like DIL Group Home Buyers, are serving a real and growing need. Homeowners are realizing that a fast, guaranteed closing is a smart, practical choice.

The key takeaway is simple: A cash offer provides control. You set the closing date, you skip the repairs, and you know exactly how much money you'll receive from day one. It's about trading a little bit of potential profit for a massive amount of peace of mind.

Finding and Vetting Legitimate Cash Home Buyers

Alright, so you've decided a cash sale is the right move. Now comes the most important part: finding a buyer you can actually trust. The "We Buy Houses" world is a mixed bag. You've got everyone from experienced local pros who know Fayetteville like the back of their hand to big national outfits and rookies just trying to get a foot in the door.

Knowing who you're dealing with is everything. A real-deal, legitimate buyer is going to be upfront, professional, and have a solid history of closing deals right here in our area. The ones to watch out for are the predators who use pressure tactics and confusing language to corner you into a bad deal.

Your mission is to find a partner who gives you a fair offer, keeps you in the loop, and follows through on their promise of a fast, no-nonsense closing. It takes a little homework, but the peace of mind is worth its weight in gold.

Spotting Red Flags in a Cash Offer

Protecting yourself starts with knowing what a sketchy deal looks like. The shady operators tend to use the same old playbook, so once you know the signs, they’re easy to spot.

The biggest red flag is high-pressure sales tactics. If someone tells you that you have to sign a contract on the spot or the "amazing offer" will vanish, that's your cue to walk away. A reputable company respects your need to think things over.

Also, be very wary of any buyer who gets cagey about showing proof of funds. A legitimate cash buyer can quickly show you a bank statement or a letter from their bank proving they have the money. If they can't, you might be dealing with a wholesaler who doesn't have the cash and is just hoping to sell your contract to a real investor.

Here are a few other warning signs to keep on your radar:

- Vague or Confusing Contract Terms: The purchase agreement should be simple and clear. If it’s loaded with jargon or escape clauses for the buyer, that's a problem.

- No Online Presence or Bad Reviews: A serious business will have a professional website, testimonials, and a presence on places like Google or the Better Business Bureau (BBB).

- Unwillingness to Answer Questions: If they're dodging simple questions about their process or fees, they’re probably hiding something.

- Offers That Seem Too Good to Be True: An offer that's way higher than everyone else's could be a "bait-and-switch." They lure you in, then slash the price after a so-called "inspection."

Essential Questions to Ask Every Potential Buyer

Before you even think about signing anything, you need to interview these potential buyers. Treat it like you're hiring someone for a crucial job—because you are. Their answers will tell you everything you need to know.

Your main goal here is to confirm two things: that they actually have the money to close, and that they know the Cumberland County market. A national iBuyer's computer algorithm can't tell the difference between a neighborhood in Hope Mills and one just outside Fort Liberty, but a local investor can.

Make a list of questions and ask the same ones to every single buyer you talk to. It makes it way easier to compare your options and see who the most solid choice is.

Key Questions for Vetting Cash Buyers:

- How long have you been buying homes in the Fayetteville area? Local experience is huge, especially with unique market factors like the constant military PCS moves.

- Can you provide proof of funds? This is a deal-breaker. You want a quick "yes" and a document to back it up.

- What does your process look like from offer to closing? They should be able to walk you through every single step without hesitation.

- Are there any fees or commissions I will have to pay? A true cash sale should have zero commissions or hidden fees. What they offer is what you get.

- Can you give me references from past sellers in North Carolina? Nothing beats talking to a real person who's been through the process with them. For more on this, our guide on how to sell your house fast in North Carolina has some extra tips.

Taking the time to check out your potential buyers is the single best thing you can do to make sure your cash sale goes smoothly. It protects you from scams, avoids nasty surprises, and keeps you in the driver's seat.

How to Prepare Your Home for a Cash Sale

Here's one of the biggest sighs of relief when you sell your home for cash: you can forget all the usual pre-sale headaches. No more weekend-long deep cleans, no staging consultations, and no frantic calls to a handyman for last-minute fixes. When you work with a direct cash buyer, the entire idea of "getting the house ready" gets flipped on its head.

The focus shifts completely. Instead of worrying about the physical condition of your property, your main job is making sure its legal standing is crystal clear. Reputable cash buyers are purchasing the home "as-is." That means they’re fully prepared to handle any repairs, junk removal, or updates themselves—it’s a core part of their business model.

What they really need from you is a clear, unobstructed path to ownership. So, your prep work is all about organizing paperwork, not scrubbing baseboards.

Forget Repairs and Staging

When a typical retail buyer walks through your home, they’re picturing their move-in-ready dream. Every scuff on the wall, every leaky faucet, every outdated light fixture can become a negotiation point or even a deal-breaker. That pressure forces sellers into a stressful and often expensive cycle of repairs and cosmetic updates.

With a cash sale, that pressure just… disappears. An experienced investor can see right past the surface-level stuff and accurately price out the cost of repairs on their own.

That peeling paint in the living room? The carpet stains from years of family life? The HVAC system that’s seen better days? A direct buyer has already factored these things into their offer. You don't need to lift a finger or spend a dime fixing them.

This "as-is" approach is a game-changer, especially for people dealing with an inherited property full of old belongings or for homeowners facing financial stress where finding cash for repairs just isn't an option.

Your Document Preparation Checklist

While you get to skip the physical labor, you can’t skip the paperwork. Getting your documents in order is the single most important thing you can do to guarantee a fast, smooth closing. It shows you're an organized and serious seller, and it helps the closing attorney clear the title without hitting any snags.

Think of it like putting together a file that tells the complete story of your ownership.

Here’s what you should pull together:

- The Deed: This is the legal document proving you own the property. If you can't find your copy, don't panic—the closing attorney can usually pull one from the county records.

- Mortgage Statements: You'll need the most recent statement showing your current loan balance and account number.

- Info on Other Liens: This includes any second mortgages, home equity lines of credit (HELOCs), or any judgments filed against the property.

- HOA Information: If your home is in a community with a homeowners' association, find the contact info and any recent statements or notices.

- Property Tax Records: Your latest property tax bill is a huge help for the closing attorney so they can prorate the taxes accurately.

Having these items ready to go can easily shave days—or even weeks—off the closing timeline. It’s the fastest way to get you to the finish line and get that cash in your hand.

Understanding the Cash Offer and Closing Process

When a cash offer lands in your hands, it can feel like a massive weight has been lifted. But it's still smart to know exactly what you're looking at. Unlike a typical offer that’s often loaded with confusing clauses and conditions, a real cash offer is all about simplicity and certainty.

It’s a straightforward deal: we want to buy your home for a specific price, exactly as it is right now. No strings attached.

The real magic behind this is the complete removal of the biggest headache in real estate: buyer financing. There are no mortgage applications to wait on, no picky underwriters to please, and zero worries about a low appraisal killing the deal at the last minute. This is precisely why we can close so incredibly fast compared to a traditional sale.

The offer you get from us will be clean and clear. It will state the price, your property address, and a closing date that works for you. Most importantly, it's an "as-is" offer. That means you don't have to lift a finger—no repairs, no upgrades, not even any cleaning before you go.

Deconstructing the Key Terms in Your Offer

When you look over the purchase agreement from a cash buyer, a few terms really matter. Getting a handle on these is key to seeing the true value of the offer, which goes way beyond just the final price. These are the terms that make the process to sell your home for cash so powerful and stress-free.

- "As-Is" Sale: This is the heart of a cash offer. It means the buyer is taking the property in its current state, problems and all. You won’t be hit with a list of demands to fix a leaky pipe, patch the roof, or redo the kitchen.

- No Contingencies: A normal offer is usually "contingent" on a bunch of things—the buyer securing a loan, the house appraising for a certain amount, or a perfect inspection report. A cash offer cuts through all that, making the deal a sure thing.

- Proof of Funds: Any serious cash buyer will have no problem showing you a document, like a bank statement, that proves they have the money ready to go. This is your guarantee that they can actually close the deal.

The fact that there are no contingencies is what provides the rock-solid certainty so many sellers are desperate for. It turns a "maybe" into a "definitely," so you can actually start planning your next move with confidence.

The Closing Timeline: What to Expect

The speed of a cash closing is often what brings homeowners to us in the first place. By taking the banks completely out of the equation, the whole timeline gets compressed in a big way. From the moment you say "yes" to the offer, we move onto a simple, direct path managed by a local closing attorney.

Here in North Carolina, an attorney handles the closing, not a title company. Their job is to run a title search to make sure the property is clear of any liens or ownership claims, get the closing paperwork ready, and handle the final transfer of money and keys. This professional oversight protects both of us.

Once you sign the purchase agreement, the attorney starts the title search. This is often the longest step, but it’s still worlds faster than waiting on a bank's underwriting department. As soon as the title comes back clear, we can set the closing date.

Typical Closing Timeline: Cash Sale vs. Financed Sale

This table really puts the speed advantage into perspective. When you're dealing with banks, appraisals, and underwriters, the process can drag on for what feels like an eternity. With a cash sale, it's a sprint to the finish line.

| Milestone | Cash Sale Timeline | Traditional Sale Timeline |

|---|---|---|

| Accept Offer | Day 1 | Day 1 |

| Title Search | Days 2-7 | Days 1-30+ (Appraisal & Loan Processing) |

| Document Prep | Days 8-9 | Days 30-45 |

| Final Closing | As soon as Day 10-14 | Typically Day 45-60+ |

| Receive Funds | Immediately at closing | Immediately at closing |

A huge benefit of working with a direct buyer like DIL Group is total transparency on costs. The offer you accept is the exact net amount you walk away with. There are no realtor commissions (which can eat up 5-6% of your sale price) and absolutely no hidden fees. We cover all standard closing costs, which means you know your final payout right from the very start. No surprises.

Tackling Tough Home Selling Scenarios

Every homeowner's situation is unique. The reasons for selling a house can be deeply personal and, let's be honest, often complicated. Here in Fayetteville and Cumberland County, we have our own set of challenges—from the constant rhythm of military relocations to the headache of managing a property from across the country.

When you're in one of these situations, a traditional home sale can feel like trying to fit a square peg in a round hole. This is where selling for cash stops being just an "alternative" and becomes a real, targeted solution. It’s not a one-size-fits-all approach; it’s about having the right key for a very specific lock.

The Military PCS: A Race Against the Clock

For our military families at Fort Liberty, a Permanent Change of Station (PCS) order fires the starting pistol on a race you can't afford to lose. The traditional market moves at its own pace—listing, showing, negotiating, and closing can drag on for months. That’s a luxury most military families just don't have.

Imagine your house is under contract, and at the last minute, the buyer’s loan falls through. That’s not just an inconvenience; it’s a potential disaster that could leave you paying a mortgage in North Carolina from your new duty station.

Selling your home directly for cash cuts right through that uncertainty.

- A Guaranteed Closing Date. You set the date. We align the closing with your PCS timeline, so you can move without looking back.

- No Showings, No Hassles. Prepping for a major move is chaotic enough. You shouldn't have to live in a "show-ready" home for weeks on end. We'll do a single walkthrough, and that's it.

- Sell It "As-Is". Forget about spending your last few weeks in town fixing leaky faucets or repainting the living room. We buy the house as it is, saving you time, money, and a lot of stress.

A cash offer delivers the one thing a military family needs most: certainty. You can focus on your next chapter knowing your house is sold and the funds are on their way.

Selling a Local Property from Out of State

Whether you've inherited a family home or you're a landlord tired of managing a rental from afar, dealing with a property from another state is a massive headache. Coordinating repairs, interviewing agents, and signing paperwork remotely can feel like a second job.

A vacant house is a magnet for problems—vandalism, storm damage, and endless utility bills. A direct cash sale cuts through all of it. You can manage almost the entire process without ever having to book a flight to Fayetteville.

No more hiring contractors, managing cleanouts, or sifting through a loved one's belongings. An investor buys the property completely as-is, taking on the house and everything in it. It allows you to settle an estate or liquidate an asset cleanly and move on. For a deeper dive, our guide on how to sell a house fast in Fayetteville, NC walks you through the details.

Getting Past Serious Property Hurdles

Some houses just come with baggage. Big baggage. Things like foreclosure, property liens, or nightmare tenants can stop a traditional sale dead in its tracks. Retail buyers need bank loans, and banks get very nervous about homes with legal or financial complications.

This is where an experienced cash buyer is your best bet. We're equipped to untangle these messes.

- Facing Foreclosure? A fast cash sale can close before the auction date. This allows you to pay off the bank, protect your credit, and potentially walk away with some equity in your pocket.

- Dealing with Liens? Whether it's from unpaid taxes or a dispute with a contractor, cash buyers and their title experts can work to clear these liens at closing.

- Problem Tenants? If you have tenants who won't pay or won't leave, we can buy the property with them still in it. We'll handle the difficult and lengthy eviction process so you don't have to.

When the normal path is blocked, selling for cash is more than just a convenience—it's a strategic exit. It turns a complex, stressful problem into a simple, straightforward transaction.

Got Questions About Selling Your House for Cash? We've Got Answers.

Deciding to sell your home for cash is a big step, and it's totally different from the traditional way of doing things. It's smart to have questions. Here are some of the most common ones we hear from folks right here in Fayetteville and Cumberland County.

How Do You Come Up With the Cash Offer for My House?

This is usually the first thing people ask, and it's a fair question. There’s no mystery to it—we use a simple, transparent formula. We start with the After-Repair Value (ARV), which is what your house could sell for on the market if it were completely fixed up and in perfect shape.

From that number, we subtract the cost of all the repairs needed to get it to that point. We also have to account for our business expenses, like holding costs while we do the work, and a small margin to keep the lights on. What’s left is your fair, no-pressure cash offer, based on real numbers and the current local market.

Are Companies That Buy Houses for Cash Legit?

Like any industry, there are good guys and bad guys. But yes, there are plenty of legitimate, professional companies out there. The trick is knowing how to spot them.

A real professional will have a solid online presence, real testimonials from local sellers you can verify, and a local representative you can meet. They’ll never pressure you into a quick decision.

Most importantly, any serious cash buyer can provide proof of funds. This is a bank statement or an official letter showing they actually have the money to buy your house. If they can’t or won’t show you this, it's a huge red flag. Walk away.

Will I Really Pay Zero Commissions or Fees?

Yes, absolutely. This is one of the biggest reasons people choose to sell for cash. When you sell directly to a company like DIL Group Buyers, you pay zero realtor commissions. That alone saves you the typical 5-6% of the sale price. We also pay for all the standard closing costs.

The offer we make is the exact amount of money you'll receive at closing. No hidden fees, no surprise charges on the settlement statement. It’s clean and simple.

The beauty of a cash sale is its financial clarity. The number you agree to is the number on the check. You can plan your next move without worrying about thousands of dollars being skimmed off the top.

Seriously, How Fast Can We Close the Deal?

The speed is no joke. Since there are no banks or mortgage lenders involved, we skip weeks—sometimes months—of underwriting, appraisals, and loan approvals.

Once you accept our offer, the main step is a routine title search by a local attorney to make sure the property is free of liens. This whole process can move incredibly fast. We can often close in as little as 7 to 14 days. But here's the best part: the timeline is on your terms. If you need more time to pack or figure out your next move, we can set the closing for whatever date works for you.

What if My House Is in Really, Really Bad Shape?

Don't give it a second thought. "As-is" means exactly what it says. We buy houses in any condition imaginable, whether it just needs a coat of paint or a full-gut renovation.

Believe me, we’ve seen it all:

- Cracked foundations

- Roofs that are more like sieves

- Old, dangerous wiring and plumbing

- Homes with fire or flood damage

- Even hoarding situations

You don't have to lift a finger to clean, haul away junk, or fix a single thing. We build the cost of dealing with all that into our offer. You just take what you want and leave the rest for us to handle after we close. It saves you a ton of time, money, and headaches.

Do I Still Need a Real Estate Agent?

Nope. When you sell directly to us, you cut out the middleman. That's how you avoid paying those big commissions.

But that doesn't mean it's the Wild West. The entire transaction is still managed by a professional closing attorney right here in North Carolina. They handle all the legal paperwork and make sure the title transfer is done correctly, protecting both you and us. You get the peace of mind of professional oversight without the cost of an agent.

When you're ready for a sale that's fast, certain, and free of stress, DIL Group Buyers is ready to help. Get in touch today for your free, no-obligation cash offer and see just how easy selling your house can be. You can learn more about how we do things at https://dilgrouphomebuyers.com.