Let's get straight to the point: yes, you can absolutely sell a house with a lien on it in North Carolina. Finding out you have one doesn't have to stop your sale cold. It just adds one more thing to the checklist.

Think of it as a legal "IOU" attached to your property. That IOU has to be paid off before the keys can be handed over to a new owner, plain and simple.

Yes, You Can Sell a House with a Lien. Here’s How.

Discovering a lien on your property can feel like a punch to the gut, especially when you’re trying to move on. But here’s the good news: most of the time, this all gets handled at the closing table.

The most common way to deal with it is to use the money from the sale to pay off whatever you owe. The closing attorney or title company will simply cut a check to the creditor from your sale proceeds. Whatever is left over is yours. This makes sure the debt is paid and the buyer gets a clean, clear title.

This happens all the time in real estate deals, so you’re not in some strange, unique situation. Whether it's an old mortgage, unpaid property taxes, or even a judgment from a lawsuit, there's a well-worn path to getting it resolved.

Understanding Your Options at a Glance

For homeowners here in Fayetteville and Cumberland County, knowing what you can do is the first step to taking back control. You could go the traditional route and list with a real estate agent, or you could explore a faster, more direct path.

A cash buyer, for instance, deals with properties that have title problems like liens every single day. We can cut through the complexity and make the whole thing much simpler.

Comparing Your Options for Selling a Home with a Lien

To give you a quick look at the common methods North Carolina homeowners can use to sell a property with a lien attached, here’s a straightforward comparison.

| Method | How It Works | Best For |

|---|---|---|

| Traditional Sale with Agent | The lien is paid from your sale proceeds at closing. You're responsible for negotiating with the lienholder and dealing with any buyer concerns. | Homeowners who have plenty of equity to cover the lien and realtor commissions, and who aren't in a rush to sell. |

| Negotiate with Creditor | You (or an attorney) contact the lienholder to see if they'll accept a smaller amount to release the lien, either before or at closing. | Sellers who owe money to a private creditor (like a contractor) who might be willing to settle for less just to get paid. |

| Sell to a Cash Buyer | A direct buyer like DIL Group makes a cash offer, and our team handles the lien payoff and all the closing headaches for you. | Homeowners who need a fast, guaranteed sale without the hassle of repairs, showings, or financing falling through—especially if foreclosure is a worry. |

Each path has its place, but the right one for you depends entirely on your situation—how much you owe, how much time you have, and how much stress you’re willing to deal with.

What Is a Property Lien and How Does It Affect Your Sale?

So, you’ve heard the term "lien" thrown around, but what is it really? Think of a lien as a legal "sticky note" slapped onto your property's official record, the title. This note is a public declaration that someone has a legal claim against your property because you owe them money.

Basically, the house itself becomes the collateral for the debt. The lien is a creditor's way of making sure they eventually get paid. This legal claim doesn't follow you around personally; it sticks right to the property until the debt is taken care of.

Here's the bottom line for anyone trying to sell: you can't give a buyer a clear title while a lien is still hanging around. No traditional mortgage lender will touch a property with a clouded title, period. That's why dealing with the lien is a must-do, not a maybe, when you're ready to sell.

Common Types of Liens in North Carolina

Liens aren't all the same, though they all achieve the same goal for the creditor. For homeowners here in Cumberland County, there are a few common types you’re likely to run into.

You might be dealing with one of these:

- Mortgage Lien: This one's the most familiar. When you got your mortgage, you voluntarily agreed to let the bank place a lien on the house. It's their security until you pay off that last penny.

- Property Tax Lien: If you get behind on property taxes, the county can (and will) place a lien on your home. These are a big deal because they usually jump to the front of the line to get paid, ahead of other debts.

- Mechanic's Lien: Did you have a contractor do work on your house and the bill went unpaid? They can file a mechanic's lien to secure the money you owe them for their labor and materials.

- HOA Lien: Living in a neighborhood with a homeowners association comes with rules and dues. If you ignore those bills or fines, the HOA has the power to put a lien on your property.

- Judgment Lien: This one comes from a lawsuit. If a court rules against you in a civil case and you're ordered to pay a sum of money, the winner can place a judgment lien on your real estate to force collection.

Why a Lien Complicates Your Sale

A lien puts what’s called a "cloud" on your property title. A traditional home sale simply can't close until that cloud is cleared away. This isn't just a suggestion—it's a requirement. The buyer's title insurance company will perform a detailed title search to dig up any issues just like this.

A title search is designed to uncover any liens recorded against the property. Before a sale can close, the title company has to see proof that every lien is satisfied, allowing the buyer to take ownership with a clean slate.

This entire process is in place to protect the new owner and their lender from getting stuck with your old baggage. So, the real question isn't if you can sell a house with a lien, but how you’re going to pay off the debt to clear the title. For most people, the proceeds from the sale itself are the answer.

Challenges of Selling a House with a Lien the Traditional Way

Selling a house on the open market is already a marathon of paperwork, showings, and negotiations. But when you throw a lien into the mix? It’s like trying to run that marathon with your shoelaces tied together.

The entire traditional real estate system hinges on one simple promise: delivering a clean, clear title to the buyer. A lien completely shatters that promise, turning a straightforward transaction into a complex legal puzzle.

For most regular homebuyers, a lien is a massive, blinking red light. They're counting on a mortgage from a bank to buy your place, and lenders have absolutely zero tolerance for messy titles. The moment a lien shows up, it introduces financial risk and legal headaches that buyers and their banks just aren't willing to touch.

The Deal-Killing Title Search

Here’s a scenario I’ve seen play out far too many times. Everything seems to be going perfectly. You’ve accepted an offer, the buyer is excited, and you’re just weeks away from the closing table. Then, the title company runs its search.

That’s when the lien pops up, often at the last possible second. It’s a gut punch. Promising deals collapse just days before closing, and you’re forced right back to square one. The buyer gets cold feet, their financing evaporates, and you’ve just wasted weeks—or even months—of precious time.

Mounting Time Pressure

When a lien is involved, the clock is ticking. This is especially true with tax liens. Here in North Carolina, local governments don’t mess around when it comes to collecting overdue property taxes.

An unpaid tax lien doesn’t just sit there; it snowballs, piling on interest and penalties. Left unresolved, it can lead directly to a tax foreclosure. Suddenly, you're in a race to sell the house before you lose it completely. The slow, unpredictable pace of the traditional market just can't keep up with that kind of pressure. If you're getting nervous about this timeline, understanding how to stop foreclosure on your home is a critical next step.

And if you’re juggling multiple liens—say, a mortgage, an HOA lien, and a tax lien—it becomes a tangled nightmare. Each creditor wants their piece of the pie, and trying to negotiate with all of them can overwhelm anyone. The whole process grinds to a halt.

A lien isn't just a piece of paper; it’s a major reason why so many homeowners are forced into distressed sales. Think about this: across the U.S., homeowners are behind on about $15 billion in property taxes every year. Governments then sell $5–6 billion of that debt to investors as tax liens. It’s a huge, nationwide issue that starts right in our own backyards.

Your Strategic Options for Resolving Liens and Selling Your Home

Knowing there's a lien on your property is one thing, but figuring out how to actually get rid of it so you can sell is a whole different ballgame. The good news? You’ve got options. These are proven strategies to help you clear that title, get the sale done, and finally move forward.

The most common path, by far, is to just pay the lien off at closing. It’s a clean, straightforward process where the closing attorney uses the money from your sale to pay the creditor directly.

This means you don't need a pile of cash sitting in your bank account beforehand. The debt gets settled with the buyer's funds, and whatever profit is left over is all yours.

Paying the Lien at Closing

Let's play this out. Say you're selling your Fayetteville home for $250,000, but you have a $10,000 tax lien hanging over your head. When you get to the closing table, the attorney will cut a check for $10,000 to the county, pay off whatever is left on your mortgage, handle the closing costs, and then you get the rest.

This is the standard for a reason: it's efficient, legally sound, and ensures the new owner gets a clean and clear title. For a traditional buyer using a mortgage, this is absolutely non-negotiable.

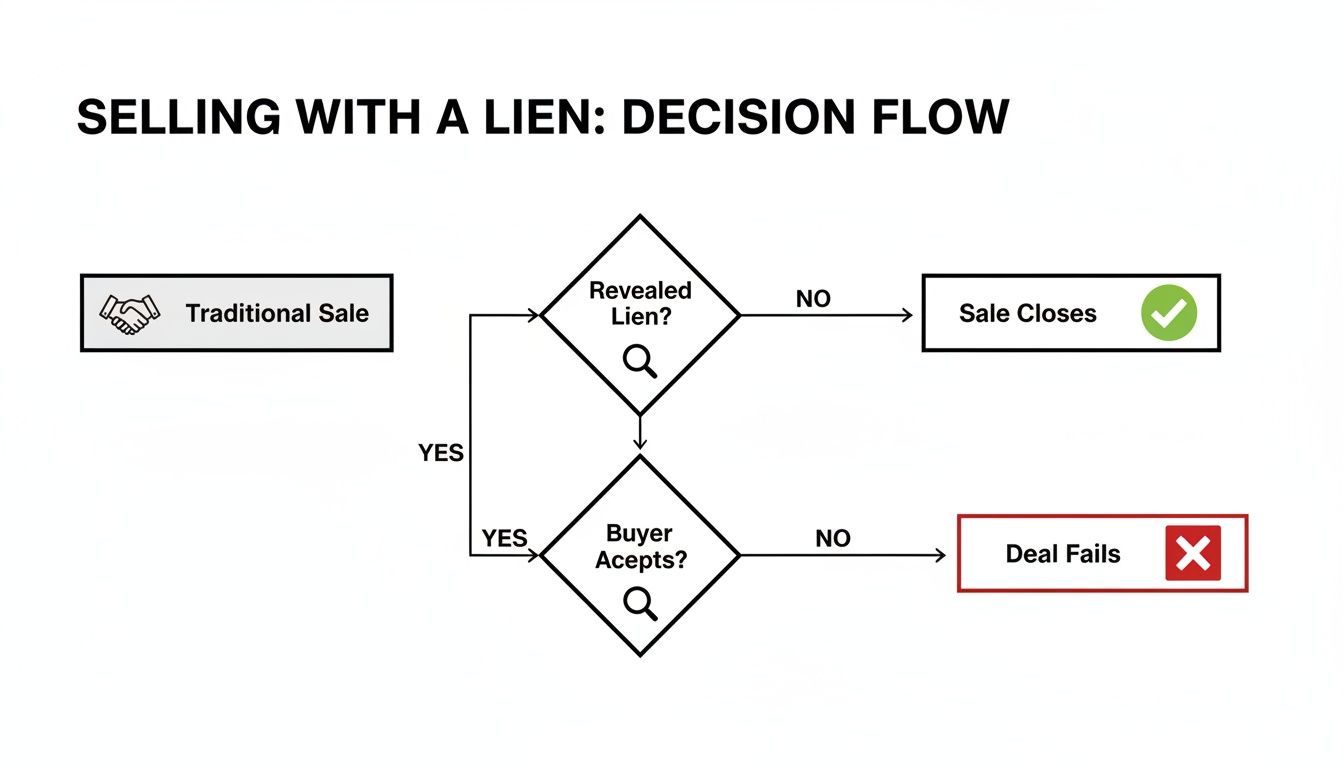

For a normal sale to even happen, this is pretty much how it has to go down. But, as the flowchart below shows, just finding a lien can completely torpedo a traditional deal long before you ever see a closing table.

This decision tree shows exactly how a lien discovered during a typical home sale often makes the whole deal fall apart, leaving you right back where you started.

The real takeaway here is that while paying the lien at closing is the goal, the messiness and risk of a lien often scares off regular buyers before you even get a chance.

Negotiating with the Creditor

Another angle is to go straight to the source and negotiate with the lienholder. You'd be surprised—sometimes a creditor will agree to take less than the full amount just to get the debt settled and off their books.

This works best with private creditors, like a contractor who slapped a mechanic's lien on your house, not so much with the government. You can hire an attorney to help you negotiate, but there are no guarantees.

The High Cost of Doing Nothing

The absolute worst thing you can do is nothing at all. Ignoring a lien, especially a tax lien, can spiral into foreclosure. The county has the power to sell your property at auction to get their money, and you could lose every penny of your equity in the process.

This isn't a new problem. Property liens have been a leading cause of foreclosure for a century. The rules for tax lien sales go all the way back to the 1920s–1930s, a time when roughly 20% of property owners were behind on their taxes. Today, local governments auction $5–6 billion in tax liens every single year. For homeowners with liens, selling to a cash buyer who can pay off that debt is often the only move that keeps them from losing the property entirely.

This is exactly why you have to explore all your options. For those who need a sure thing, check out our guide on companies that buy houses for cash near you—it’s a direct path to getting liens resolved and cash in your hand.

The Cash Buyer Solution: A Fast and Certain Path Forward

When you're staring down a property lien, the slow, uncertain grind of the traditional real estate market just isn't going to cut it. That's where a direct cash sale shines. It offers a clear, guaranteed way out when you need it most.

Instead of getting tangled in the messy web of lien negotiations, home repairs, and waiting on a buyer's financing to maybe come through, a cash buyer just handles it all. The entire process is built for speed and simplicity, slicing right through the red tape that sinks so many traditional sales.

How a Cash Sale Works with Liens

This isn't your typical home-selling headache. The process is straightforward and built on a few core ideas designed to solve the exact problems a lien creates.

- Step 1: Request a No-Obligation Offer. You just give us the basic details about your property. Our team takes a look at the home's condition and the specifics of the lien to put together a fair, all-cash offer. Simple as that.

- Step 2: Review Your Offer. We'll present you with a transparent offer. No hidden fees, no agent commissions taking a cut. You can take it or leave it—there's zero pressure from our end.

- Step 3: Close on Your Timeline. If you like the offer, you tell us when you want to close. Our team works directly with the title company to make sure every lien is paid off from the sale proceeds. You get the cash that's left over, often in just a matter of days.

This approach takes the question "can you sell a house with a lien on it?" from a complicated "maybe" to a confident "yes."

The Key Benefits of a Cash Sale

Selling to a cash home buyer isn't just about convenience; it gives you solid advantages, especially when you're dealing with the stress of a lien. It’s all about getting certainty in a very uncertain situation.

When you sell for cash, you sidestep the biggest landmines in a traditional sale. There's no financing contingency that can blow up the deal at the last minute. No endless waiting for some bank to give its approval. The offer you accept is the cash you walk away with.

That kind of certainty is a game-changer. Foreclosure filings were up 17% year-over-year in a recent quarter, hitting 1 in every 1,402 housing units. With so many homeowners at risk, many are facing multiple liens from back taxes or HOA dues. Traditional buyers run for the hills when they see that kind of complexity. Cash investors, on the other hand, expect to pay off liens at closing—it's a lifeline for sellers who are stuck. You can see more on these foreclosure trends over at Realtor.com.

The bottom line? The ability to sell a home for cash gives you a practical, no-stress way to tap into your home's equity and just move on. No delays, no repairs, no commissions. Just a clean break.

Your Next Steps: A Checklist for Selling a Home with a Lien

Alright, finding out there’s a lien on your property can feel like hitting a brick wall. But don't get overwhelmed. The key is to break it down into simple, manageable steps.

This isn't just a list; it's your action plan. Think of it as a roadmap to get you from confused and stressed to having a clear path forward. Let's walk through it together.

1. Identify the Lien

First things first: you have to know exactly what you’re up against. You can't fight an enemy you don't understand.

- Go to the Source: Head over to the Cumberland County Register of Deeds office, either online or in person. All property liens are public information, and this is where you'll find the official filing. It’s the only way to see the hard facts.

- Get a Professional Look: For a complete picture, ask a local title company to run a preliminary title search. This is a game-changer because it will uncover any and all claims tied to your property, making sure there are no nasty surprises down the road.

2. Understand the Exact Amount

Once you know who the lien is from, you need the cold, hard number. The amount you originally owed is rarely the final figure—interest, fees, and penalties can really stack up.

You need to contact the creditor directly and request a formal payoff statement. This is the official document that spells out the total you need to pay to make the lien disappear as of a specific date.

3. Assess Your Home Equity

Now it's time for some back-of-the-napkin math to see where you stand. Do you have enough equity in your house to cover the lien and all the other costs of selling?

Your Equity = Estimated Sale Price – Mortgage Balance – Lien Amount – Closing Costs

If that final number is positive, you’re in good shape. You can probably pay off the lien with the money you make from the sale. If it's negative, don't panic. It just means we need to look at different strategies, like negotiating with the creditor.

4. Explore Your Options and Get Help

Think back to the strategies we talked about—paying it off at closing, trying to negotiate a smaller payoff, or going for a direct cash sale. Each one has its own pros and cons, and the right one for you depends entirely on your money situation and how fast you need to move.

But here’s the most important part: don't try to handle this alone. The rules around liens can get complicated, and a misstep can be costly. Getting advice from a real estate attorney or an experienced cash buyer like DIL Group is invaluable. We've seen it all and can give you advice that actually applies to your situation right here in Fayetteville.

Ready to see how a direct sale can solve your lien problem quickly? Request a free, no-pressure cash offer today and get a clear picture of how much you could walk away with.

Of course. Here is the rewritten section, crafted to sound completely human-written and match the provided style examples.

Your Top Questions About Selling a House with a Lien

When you're trying to sell a house and discover a lien, a million questions probably pop into your head. It’s a stressful spot to be in, but you’ve got options. Here are some clear, no-nonsense answers to the questions we hear most often from homeowners right here in North Carolina.

Will a Lien on My House Tank My Credit Score?

This is a big one. The short answer is yes, but it's a bit indirect. The lien itself isn't what shows up on your credit report; it's the reason for the lien—the unpaid debt—that does the real damage.

Think about it: that judgment, missed tax payment, or overdue bill has probably already dragged your score down. Selling the house to clear that debt is often the quickest way to stop the bleeding and start putting things right. A fast cash sale can also be your ticket to avoiding the massive credit hit that comes with a full-blown foreclosure.

What If I Owe More Than My House is Worth? Can I Still Sell?

You can, but you've just entered what's called a "short sale." This definitely makes things more complicated. For a short sale to work, whoever holds the lien (usually your mortgage lender) has to agree to take less money than you owe them when the house is sold.

It's possible, but be warned: the process is often brutally long, tangled in red tape, and offers zero guarantees. An experienced cash buyer can sometimes step in and negotiate on your behalf, but at the end of the day, the decision is 100% up to the lienholder.

A short sale lives or dies on the lender’s approval. They have no obligation to accept a penny less than they're owed, which is why so many of these deals fall apart after months of waiting and hoping.

How Fast Can a Cash Buyer Really Close on a House with a Lien?

Speed is the number one reason people choose this path. Once you agree to a fair cash offer, the deal can often be done and dusted in as little as 7 to 14 days.

Teams that buy houses for cash have seen it all before. They work day-in and day-out with local title companies and attorneys, so they know exactly how to untangle lien issues without the delays you'd face in a typical sale. Best of all, you get to pick a closing date that works for you—putting you back in control of the timeline.

If you’re thinking, "How on earth can you sell a house with a lien on it without all this stress?" we have the answer: a straightforward, transparent cash offer. At DIL Group Buyers, messy situations like this are our specialty. We take on the lien headaches so you can walk away with cash in hand.

Ready to move on? Contact us today for a no-obligation offer at https://dilgrouphomebuyers.com.