It’s a question that catches many homeowners off guard: can my HOA really take my home? The answer, unfortunately, is yes. In North Carolina, a homeowners association has the legal muscle to foreclose on your property if you fall behind on dues and other fees.

It’s a shocking reality for many, but the power an HOA holds is serious. They can place a lien on your property for delinquent payments, and that single action can start a domino effect that ends with you losing your home—sometimes over what seems like a small amount of money.

Understanding the Power of an HOA Lien

When you bought your home, you didn’t just buy a piece of property; you bought into a community with a set of rules. Those governing documents you signed at closing are a binding contract. They give the HOA the authority to collect assessments for everything from landscaping to major repairs.

If you stop paying, the HOA can put a lien on your property.

Think of an HOA lien like a legal sticky note attached to your home’s title. It’s a formal claim against your property, similar to the one your mortgage lender holds. This lien secures the debt you owe, and once it's on the books, it casts a shadow over your title. Selling or refinancing becomes nearly impossible. If you're trying to figure out how to navigate this, our guide on selling a house with a lien digs deeper into how these claims complicate a sale.

How a Lien Becomes a Foreclosure

The lien is just the first shot across the bow. If you don't settle the debt, the HOA can take the next step: judicial foreclosure.

This isn’t a quick process. The HOA has to file a lawsuit and convince a judge to issue a court order allowing them to sell your home. The money from that sale is then used to cover what you owe—the original dues, plus late fees, interest, and the HOA’s attorney fees. Because it all happens through the court system, it’s a bit different from a typical mortgage foreclosure, which can often happen without a judge’s involvement.

It’s a common myth that HOAs only foreclose when you owe thousands. While they’re more likely to act when the debt is substantial, they have the legal right to foreclose no matter the amount. That's why it's so critical to understand the process before it's too late.

The Broader Foreclosure Landscape

While it's tough to find exact numbers just for HOA foreclosures, the overall economic picture tells a story. Across the country, foreclosure starts have shot up 20 percent year-over-year. That’s a clear sign that more homeowners are feeling the squeeze from rising costs.

Even more telling, completed foreclosures have jumped 32 percent compared to last year. These national trends show that foreclosure activity has been climbing for eight straight months, which underscores just how important it is to deal with any property debt head-on.

Navigating the North Carolina HOA Foreclosure Process

Knowing the path an HOA has to follow to foreclose is your best defense against losing your home. Here in North Carolina, the process isn't a quick grab; it follows a specific legal route called a judicial foreclosure. This is a critical detail. It means the HOA can't just kick you out—they have to file a lawsuit and get a judge’s permission first.

This legal requirement creates a timeline with several distinct steps. When you understand these stages, you can see what’s coming and act at each point. It turns a scary legal threat into a manageable process where you have real opportunities to step in and fix things.

The whole thing usually kicks off the moment your account is officially "delinquent," which is just the formal term for falling behind on payments. Every missed payment, whether it's a regular monthly assessment or a special one-time fee, gets the clock ticking.

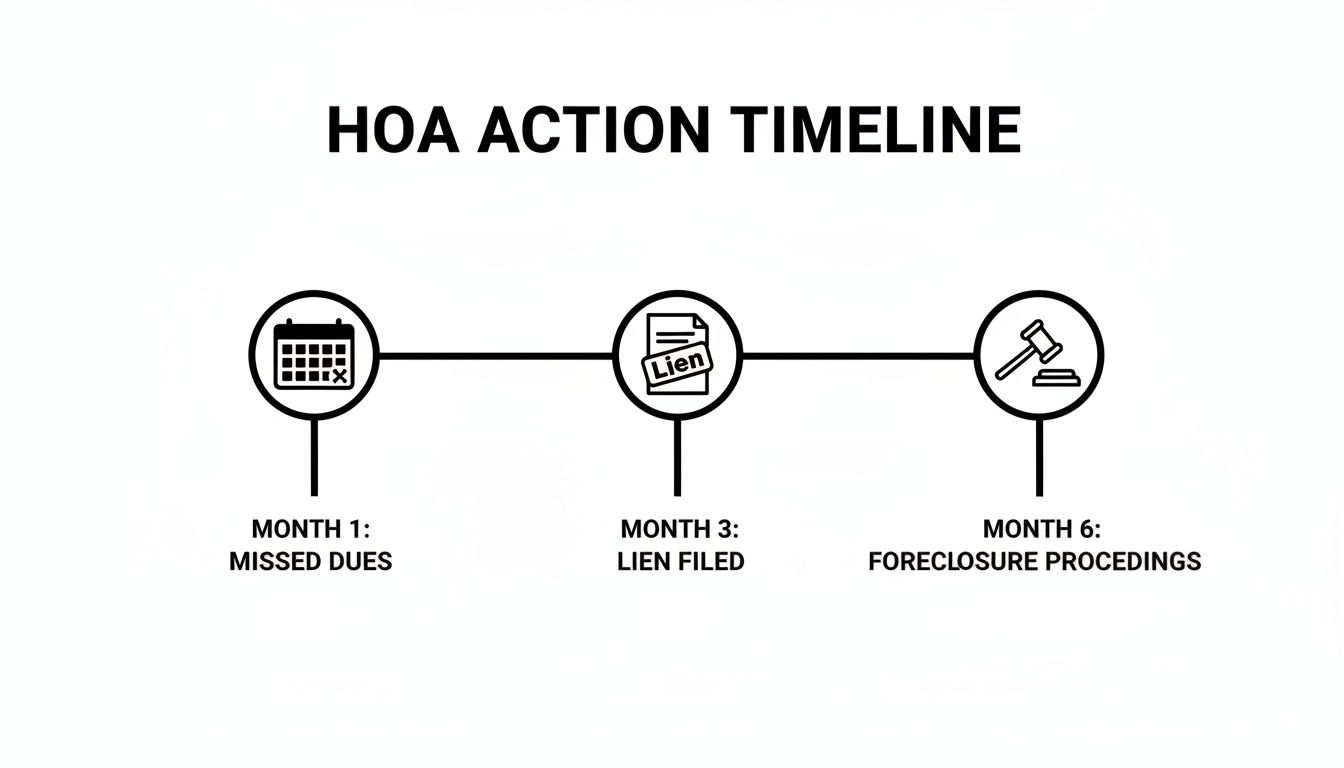

This timeline shows the typical journey from a simple missed payment all the way to a foreclosure action.

As you can see, it’s a gradual escalation. The system is designed to give you multiple chances to sort out the debt before it ever gets to a court-ordered sale.

The Initial Steps: From Delinquency to Lien

Once you’re past due, the HOA will typically start with basic collection efforts. Expect letters, maybe some phone calls, and the addition of late fees or interest to your balance, as long as it's allowed by your community's rules. If that doesn't work, things get more serious.

Their next big move is to place a formal lien on your property. This is a legal claim they file with the county that puts the world on notice: you owe the association money. A lien clouds your property’s title, making it nearly impossible to sell or refinance until the debt is cleared. In North Carolina, the HOA is required to send you a "claim of lien" notice before they can officially file it.

Crucial Takeaway: An HOA lien isn't just for the original missed dues. It also piles on all the accumulated late fees, interest, and—this is the big one—the HOA’s attorney fees for getting the lien ready and filing it. This is how a small debt can snowball into a much larger, more intimidating problem.

The lien itself doesn’t automatically trigger a foreclosure, but it's the necessary legal stepping stone to get that process started.

Filing the Lawsuit and Going to Court

If the lien is filed and the debt still isn't paid, the HOA can then take the most serious step: filing a foreclosure lawsuit. Their attorney will file a complaint in court, and you will be formally "served" with the legal papers. This is a critical moment. The absolute worst thing you can do is ignore these documents.

Once you’re served, a clock starts ticking—you usually have about 30 days in North Carolina to file a formal answer with the court. This is your chance to fight back and present any defenses, such as:

- The HOA miscalculated what you owe.

- They didn’t follow the correct legal steps to place the lien.

- The charges are for fines or violations you didn't actually commit.

If you don't respond, the HOA can win by default judgment. That means the court will likely approve their request to foreclose without ever hearing your side of the story. But if you do file an answer, the case moves forward. A judge will review all the evidence and decide whether to issue an order allowing the sale of your home.

A Look at the Bigger Picture

It’s good to remember that these situations don't just happen in a bubble. The wider economy can put a squeeze on homeowners everywhere, making foreclosures more common. Some states are getting hit harder than others, signaling widespread financial stress.

For example, Florida recently had one of the highest rates, with one in every 2,182 homes facing foreclosure. Texas and California are seeing huge numbers of new filings, too. For homeowners right here in Fayetteville and Cumberland County, these national trends are a reminder to stay on top of your finances.

Rising insurance costs, inflation, and higher property taxes all add to the pressure. While homeowners across the country collectively have over $35 trillion in home equity providing a buffer, it doesn't help much if you're the one struggling. For those managing a property from out of state, these challenges can make a quick, clean sale to a cash buyer an especially smart way to avoid the whole foreclosure mess. You can read more about these rising foreclosure trends and what’s driving them.

Knowing Your Rights as a Homeowner

When you're facing a foreclosure threat from your HOA, it's easy to feel like they hold all the power. But that’s not the full story. North Carolina law actually gives you specific rights and protections to make sure you have a fair shot at fixing the problem.

An HOA can’t just decide to sell your home on a whim. They have to follow a strict legal playbook, and that playbook is designed to give you plenty of notice and time to act. Understanding these built-in safeguards is your first and most important line of defense. It shifts the dynamic from you being a passive victim to an active participant who knows what’s coming and when.

Mandatory Notices You Must Receive

An HOA can't just blindside you with a foreclosure lawsuit. The whole process is built on a foundation of formal, written communication to keep you in the loop. Honestly, ignoring these official notices is one of the biggest mistakes a homeowner can make.

In North Carolina, the law requires several key steps before a foreclosure can even get off the ground. These aren't just polite suggestions; they are legal hurdles the HOA absolutely must clear.

- Initial Delinquency Letters: These are the first warning shots. They'll let you know you’ve missed payments and tell you exactly how much you owe, including any late fees that have been tacked on.

- Pre-Lien Letter: Before they can officially place a lien on your property, the HOA has to send you another written notice. Here in NC, this letter typically gives you 15 days to pay up before they take that next serious step.

- Notice of Intent to Foreclose: Even after a lien is on the books, they have to send yet another formal notice. This document will state their clear intention to file a foreclosure lawsuit if the debt isn't settled. It’s the final warning.

Think of these notices as your official cues to take action—whether that means paying the debt, calling them to negotiate a payment plan, or getting legal advice.

The Right of Redemption: Your Final Safety Net

Here’s a powerful protection you have as a North Carolina homeowner: the right of redemption. This legal concept is basically your final safety net, even after your home has been sold at a foreclosure auction. It gives you one last chance to buy your property back.

So, how does it work? After the foreclosure sale, a special clock starts ticking on what’s called the "upset bid period." In North Carolina, this period initially lasts for 10 days. During that time, you—or anyone else, for that matter—can go to the court clerk and submit a higher bid to try and overturn the sale.

Key Insight: Your right of redemption means you can reclaim your home by paying the full amount of the winning bid from the auction, plus any extra costs. This right lasts for the entire upset bid period, which gets extended every time a new, higher bid is placed.

This gives you a final, critical window to pull together the funds to save your home. You might use savings, get a loan from family, or even complete a fast cash sale of the property to another buyer to get the money you need. It’s a powerful tool, but you have to act fast within a very tight deadline.

Understanding the Legal Timelines

The entire process is governed by strict timelines that are meant to give you some breathing room. From the moment you get that pre-lien notice, you have a set number of days to respond before the HOA can escalate things.

Once a lawsuit is officially filed, you typically have 30 days to file a formal answer with the court.

These deadlines aren't just random numbers. They are legally required periods designed to give you enough time to figure out your options. Knowing these timelines helps you build a strategy instead of just reacting to bad news. It empowers you to get ahead of the problem before it spirals into a full-blown foreclosure.

How to Stop an HOA Foreclosure in Its Tracks

Getting a foreclosure notice from your homeowners association can feel like a punch to the gut. It's a shocking moment, but it's also the point where you need to take a deep breath and take decisive action. The good news is you have several powerful ways to stop the process, keep your home, and get back on solid financial ground. These options range from paying what's owed to negotiating a plan or making a clean break with a fast sale.

The absolute worst thing you can do is ignore it. The problem will only mushroom as late fees, interest, and the HOA's legal costs pile up, digging you into a deeper hole. Each strategy has its own timeline, so let's walk through them so you can figure out the best path forward for your situation.

Pay the Debt in Full

The most direct way to shut down an HOA foreclosure is to cure the default. That's the legal term for simply paying everything you owe. It’s the fastest route to making the whole mess disappear and getting the lien lifted from your property.

But be aware, "everything you owe" is usually more than just the missed dues. The total bill will likely include:

- Original delinquent assessments: The basic HOA fees you fell behind on.

- Late fees and interest: Penalties that have been stacking up.

- HOA's legal fees: You’ll almost certainly have to cover the money the HOA spent hiring a lawyer to file the lien and start the foreclosure process.

Before you write a check, always demand an itemized statement from the HOA. You need to verify every single charge. This approach gives you a clean slate, but it obviously requires having the cash ready to go.

Negotiate a Payment Plan

If you can’t pay it all off in one shot, your next best bet is to start talking to the HOA board. Honestly, most associations would much rather get steady payments from you than deal with the hassle and expense of a full-blown foreclosure. Coming to them proactively and respectfully can work wonders.

When you reach out, be ready to propose a realistic repayment plan. This isn't just about begging for more time; it's about offering a concrete solution. For instance, you could offer to pay your current dues on time, plus an extra amount each month to chip away at the past-due balance.

Pro Tip: Whatever you agree on, get it in writing. A formal, signed document protects you and the HOA. It clears up any confusion about the payment terms and serves as proof that you're making a good-faith effort to fix the situation.

Use Bankruptcy as a Temporary Shield

Filing for bankruptcy is a major financial decision with lasting effects, but it's also a powerful tool for stopping a foreclosure dead in its tracks. The second you file, the court issues an "automatic stay." Think of it as a legal stop sign that immediately freezes all collection attempts against you, including the HOA's foreclosure lawsuit.

Now, this doesn't make the debt vanish. What it does do is buy you precious time. The automatic stay forces the HOA to hit pause, giving you the breathing room to reorganize your finances under a Chapter 13 plan or liquidate assets in a Chapter 7. This is a complex legal move, and you should only go down this road with advice from a good bankruptcy attorney.

Sell Your Home for a Fast Cash Resolution

For many homeowners, the cleanest and most definite solution is to sell the property—fast. A quick sale lets you pay off the HOA lien, clear your mortgage, and walk away with any leftover equity. Most importantly, this strategy keeps a foreclosure from ever hitting your credit report, a black mark that can haunt you for years.

The problem is, a traditional sale on the open market is slow and full of uncertainty. Waiting months for a buyer who needs a mortgage is a gamble, especially when the clock is ticking. This is where selling to a cash home buyer like DIL Group Home Buyers becomes a game-changer. We give you a guaranteed, fair cash offer and can close in days, not months. That speed and certainty are exactly what you need when facing a foreclosure deadline. By taking control of the sale, you can learn how to stop foreclosure on your home on your own terms, protecting both your credit and your peace of mind.

Why a Cash Sale Is Your Strongest Option

When the HOA foreclosure clock is ticking, time is a luxury you just don’t have. A traditional home sale, with all its moving parts and frustrating delays, often isn't a realistic solution. This is exactly where a cash sale becomes your most powerful move—it offers a clean, fast way out of a very stressful spot.

Trying to sell on the open market means months of showings, strangers walking through your home, and just hoping a qualified buyer makes an offer. Even when they do, the deal is far from guaranteed. Everything hinges on their financing getting approved, the appraisal coming in right, and a home inspection that doesn't uncover any deal-breaking surprises.

Any one of those steps can blow up the sale, sending you right back to square one while the HOA’s legal fees keep piling up. That kind of uncertainty is a massive risk when you’re fighting a foreclosure deadline. A cash sale cuts right through all that nonsense.

Eliminate Uncertainty and Regain Control

The biggest advantage of a cash sale is certainty. Plain and simple. When a cash home buyer like us makes an offer, it’s not dependent on a bank’s approval. There's no lender to please, no appraisal to sweat over, and zero risk of financing falling apart at the eleventh hour. The offer you get is the cash you walk away with.

This reliability is a game-changer, especially for folks in specific situations:

- Military Families: A tight PCS schedule leaves absolutely no room for a sale to fall through. A cash sale locks in a closing date that works for you, so you can focus on your move.

- Inherited Properties: If you've inherited a home that’s already tangled up in an HOA dispute, a cash sale lets you resolve the whole thing quickly without getting dragged into neighborhood politics or legal battles.

- Homes Needing Repairs: A lot of homes facing HOA issues also need major repairs that the owners can’t afford. We buy houses “as-is,” which means you don’t have to spend a single dime on fixing things, cleaning, or staging.

The Bottom Line: A cash sale replaces the gamble of the retail market with the guarantee of a done deal. You get a fair offer, you pick the closing date, and you pay off the HOA debt before it can cause permanent damage to your finances.

The Power of Speed in a Foreclosure Situation

When it comes to an HOA foreclosure, speed is your best friend. The longer this thing drags on, the more fees and legal costs get tacked on, eating away at your home's equity. A traditional sale can take anywhere from 60 to 90 days to close—and that's if everything goes perfectly. A cash sale can be done in as little as a week.

This speed puts you back in the driver's seat. You can pay off the HOA lien, settle up with your mortgage lender, and walk away with the rest of the cash in your pocket. It’s the fastest way to shield your credit from the devastating hit of a foreclosure, which can follow you around for up to seven years.

For homeowners in Fayetteville and the surrounding communities, selling your home for cash is a direct, no-nonsense exit strategy. It’s a solution that gives you more than just money—it gives you peace of mind. By working with a trusted local buyer like DIL Group Home Buyers, you get a guaranteed offer and take back control of your situation. You can turn a potential financial disaster into a clean slate and move forward without the weight of that HOA debt.

Frequently Asked Questions About HOA Foreclosures

Even with a roadmap of the process, you probably still have some nagging questions. The whole idea of an HOA foreclosing on your home is a tough pill to swallow, so it's only natural to be worried about the details. Let's tackle the most common questions we hear from homeowners in North Carolina facing this situation.

What Is the Minimum Amount I Must Owe for an HOA to Foreclose?

This is the big one everyone asks, but the answer can be frustrating. Legally speaking, there is no specific minimum dollar amount in North Carolina that an HOA must reach before starting a foreclosure. If your account is delinquent and they have a valid lien, they have the right to file a lawsuit.

But here’s the reality check: judicial foreclosure is a long, expensive fight for the HOA. They're paying their lawyers for every single step. Because of that, most HOAs won't pull the trigger for a small amount. They typically reserve this nuclear option for homeowners who owe hundreds or thousands of dollars and have ignored every other attempt to collect the debt.

Can I Sell My House if a Foreclosure Lawsuit Has Started?

Absolutely. In fact, it’s often the smartest move you can make. Just because the HOA has filed a lawsuit doesn't strip you of your right to sell your property. Selling is the most powerful way to slam the brakes on the foreclosure and get back in control of your finances.

This is where a cash buyer can be a lifesaver. When you work with a company like DIL Group Home Buyers, we’re built to handle these exact complications. We work directly with the title company and the HOA’s attorneys to get an official payoff amount for the lien. That entire debt is settled at closing from the sale proceeds, clearing your title and letting the sale go through. You get to pay off the HOA, satisfy your mortgage, and walk away with cash in your pocket.

What Happens to My Mortgage if the HOA Forecloses?

This is a massive point of confusion, so listen up. An HOA foreclosure does not make your mortgage vanish. You are still 100% on the hook for paying back that entire loan, even after the HOA has sold your home at auction.

Think of it like this: the HOA foreclosure only clears the debt you owe to them. The person who buys your home at the auction gets the property, but that property still has your mortgage attached to it. Meanwhile, your name is still on the loan agreement with the bank. If you stop making mortgage payments, your lender will start their own, separate foreclosure against you.

Crucial Warning: If an HOA forecloses, you can land in the worst possible scenario: you’ve lost the house, but you still owe the entire mortgage. A fast cash sale is the only way to guarantee that both the HOA lien and the mortgage get paid off at the same time, giving you a completely clean slate.

How Does an HOA Foreclosure Affect My Credit?

An HOA foreclosure will absolutely wreck your credit score. A foreclosure is one of the worst things that can hit your credit report, and the damage is severe. It can tank your score by 100 points or more and will stay on your report for up to seven years.

That kind of black mark makes it incredibly difficult to get approved for anything—another mortgage, a car loan, even a credit card. To lenders, you suddenly look like a huge risk. The best way to sidestep this disaster is to resolve the debt before the foreclosure is final. Selling your property to a cash buyer lets you pay off the HOA and avoid the foreclosure entry on your record, protecting your credit from that massive hit.

Staring down an HOA lien or the threat of foreclosure is overwhelming, but you have options. If you need a fast, guaranteed way out, DIL Group Home Buyers can give you a fair, no-obligation cash offer to settle your debt and help you move on. We buy houses in any condition all over Fayetteville and Cumberland County. It’s a sure way to avoid foreclosure and protect your financial future. Contact us today to get your free cash offer. Find out more at https://dilgrouphomebuyers.com.